An Unbiased View of Paul B Insurance

Wiki Article

Not known Facts About Paul B Insurance

represents the terms under which the case will be paid. With residence insurance policy, as an example, you might have a replacement expense or real money worth policy. The basis of just how insurance claims are settled makes a huge effect on exactly how much you make money. You need to always ask exactly how cases are paid and what the insurance claims process will certainly be.

They will record your case as well as explore it to discover out what took place and exactly how you are covered. Once they decide you have a protected loss, they might send a look for your loss to you or perhaps to the service center if you had an auto accident. The check will certainly be for your loss, minus your insurance deductible.

The idea is that the cash paid in cases gradually will certainly be much less than the overall costs gathered. You might really feel like you're tossing money gone if you never file a case, but having piece of mind that you're covered in case you do suffer a substantial loss, can be worth its weight in gold.

The Greatest Guide To Paul B Insurance

Visualize you pay $500 a year to guarantee your $200,000 home. This implies you've paid $5,000 for home insurance.

Because insurance coverage is based on spreading the threat amongst lots of people, it is the pooled cash of all individuals paying for it that allows the firm to construct assets and also cover cases when they occur. Insurance coverage is a service. It would be wonderful for the business to just leave prices at the exact same level all the time, the fact is that they have to make enough money to cover all the potential cases their insurance holders might make.

Underwriting modifications as well as rate increases or reductions are based on results the insurance coverage firm had in previous years. They sell insurance from just one business.

Some Of Paul B Insurance

The frontline people you deal with when you purchase your insurance are the agents as well as brokers who represent the insurance business. They a familiar with that firm's items or offerings, however can not speak in the direction of various other firms' plans, prices, or product offerings.

They will have access to more than one business and need to learn about the series of items used by all the companies they represent. There are a couple of essential questions you can ask on your own that could aid you determine what type of protection you need. Just how much danger or loss of money can you assume on your very own? Do you have the cash to cover your expenses or financial obligations if you have a mishap? What about if your home or vehicle is destroyed? Do you have the savings to cover you if you can not function as a result of a mishap or disease? Can you manage greater deductibles in order to decrease your prices? Do you have special requirements in your life that require added protection? What problems you most? Plans can be tailored to your demands as well as identify what you are most stressed regarding protecting.

The insurance you require varies based on where you go to in your life, what kind of possessions you have, as well as what your lengthy term objectives and tasks are. That's why it is important to take the time to review what you desire out of your policy with your representative.

home

What Does Paul B Insurance Do?

If you obtain a funding to acquire an automobile, and also then something occurs to the auto, gap insurance will pay off any type of part of your financing that basic car insurance coverage does not cover. Some lenders require their borrowers to carry gap insurance.

The main objective of life insurance policy is to offer cash for your beneficiaries when you pass away. Depending on the kind of plan you have, life insurance coverage can cover: Natural fatalities.

Life insurance policy covers the life of the insured individual. Term life insurance coverage covers you for a period of time selected at purchase, such as 10, 20 or 30 years.

Our Paul B Insurance Statements

If you don't pass away throughout that time, no one makes money. Term life is prominent since it provides big payments at a lower cost than permanent life. It likewise gives coverage for a set variety of years. There are some variants of common term life insurance policies. Exchangeable plans permit you to convert them to irreversible life plans at a higher premium, enabling longer as well as possibly more adaptable protection.

Permanent life insurance plans construct cash money value as they age. The cash worth of whole life insurance coverage policies grows at a fixed price, while the cash worth within universal policies can fluctuate.

If you contrast average life insurance coverage rates, you can see the distinction. As an example, $500,000 of entire life insurance coverage for a healthy 30-year-old lady costs around $4,015 yearly, typically. That exact same degree of insurance coverage with a 20-year term life plan would cost approximately concerning $188 each year, according to Quotacy, a brokerage firm.

More Info

9 Easy Facts About Paul B Insurance Shown

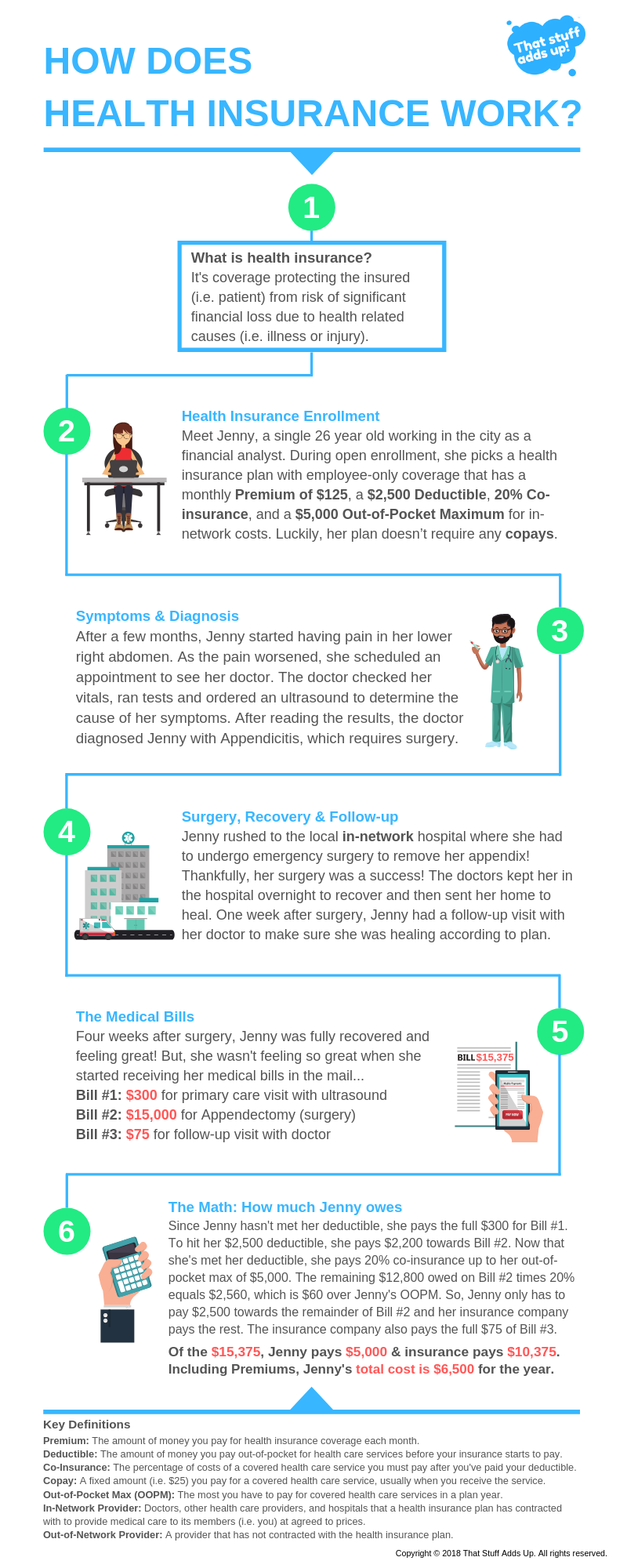

:max_bytes(150000):strip_icc()/how-does-health-insurance-work-f7aa9125e51f4f6698b38789ff3929c3.png)

Variable life is an additional long-term life insurance policy option. It's an alternative to whole life with a set payment.

Below are some life insurance fundamentals to aid you better comprehend exactly how insurance coverage works. For term life policies, these cover the expense of your insurance policy as well as management prices.

basicsReport this wiki page